Basics

Stock Market

Uncategorized

Angel One brokerage, best brokers India, best trading app India, brokerage comparison India, cheapest broker India, discount brokers India, full service brokers India, Groww vs Zerodha, HDFC Securities vs Zerodha, ICICI Direct brokerage, top stock brokers India, Zerodha vs Upstox

bullbearfin

0 Comments

Top Indian Stock Brokers 2025: Detailed Brokerage Comparison, Features & Best Picks

Introduction

The Indian stock market has witnessed tremendous growth over the past decade, fueled by rising financial literacy, technology-driven platforms, and increasing retail participation. At the core of this ecosystem are stockbrokers, who act as intermediaries between investors and the stock exchanges (NSE, BSE).

Selecting the right broker is crucial since brokerage charges, platform features, and additional services directly impact your profitability as an investor or trader. In this article, we will provide a detailed comparison of leading Indian brokers, covering their brokerage fees, features, and which type of investor they are best suited for.

Types of Brokers in India

- Full-Service Brokers

- Provide research, advisory, relationship managers, and multiple investment products.

- Usually have higher brokerage charges.

- Examples: ICICI Direct, HDFC Securities, Kotak Securities, Motilal Oswal, Sharekhan.

- Discount Brokers

- Focus mainly on trading platforms with lower brokerage costs.

- Offer limited or no research/advisory.

- Examples: Zerodha, Upstox, Angel One, 5paisa, Groww, Fyers.

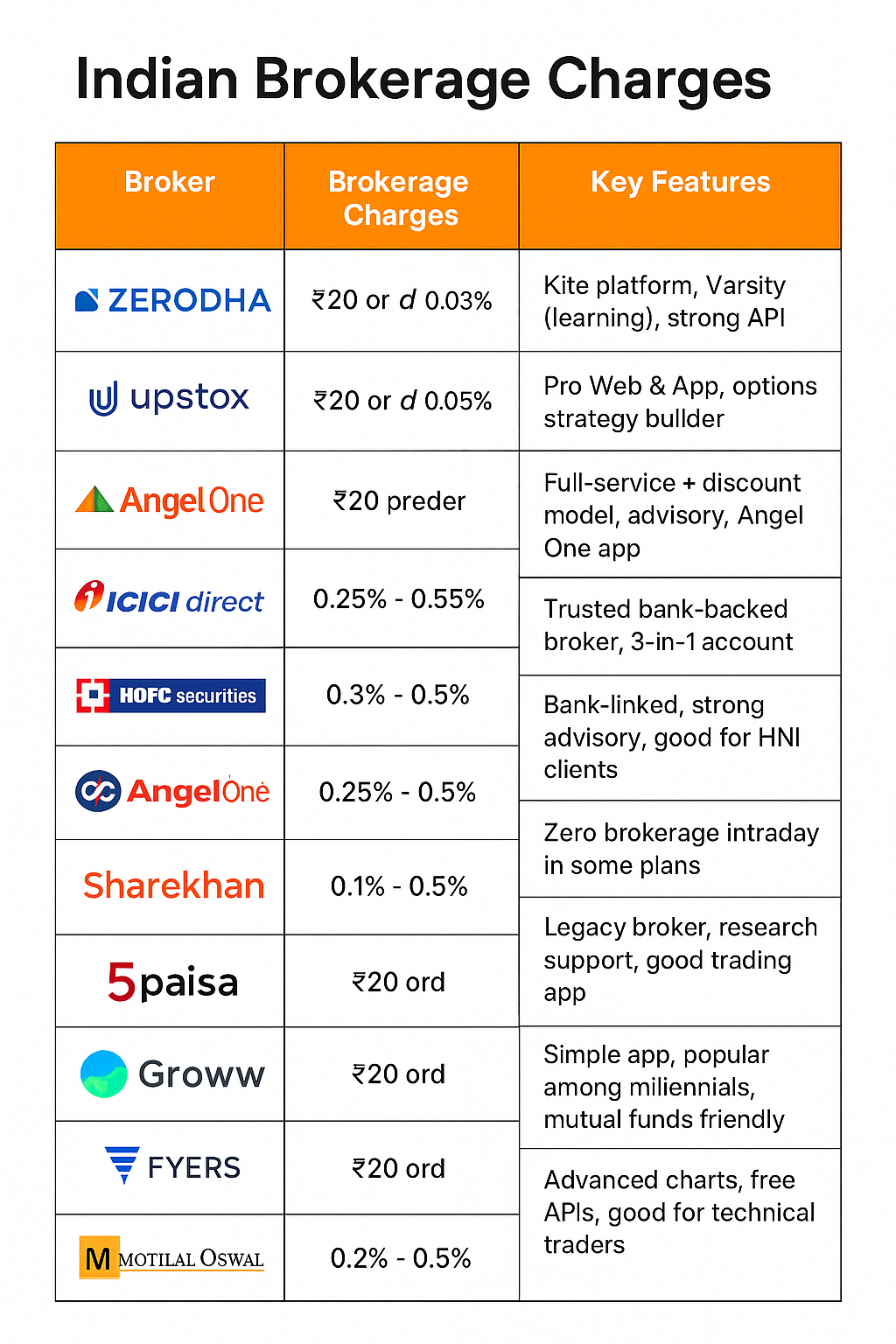

Brokerage Comparison of Top Indian Brokers

Below is a comparative analysis of leading brokers in India (2025 updated data):

| Broker | Brokerage Charges | Account Opening Fee | AMC (Annual Maintenance) | Key Features | Best For |

|---|---|---|---|---|---|

| Zerodha | ₹20/trade or 0.03% (whichever lower) | ₹200 | ₹300/year | Kite platform, Varsity (learning), strong API | Traders & investors who want low-cost trading |

| Upstox | ₹20/trade or 0.05% | ₹0 (offers) | ₹150-300/year | Pro Web & App, options strategy builder | Active traders & beginners |

| Angel One | ₹20/trade flat | ₹0 | ₹240/year | Full-service + discount model, advisory, Angel One app | Beginners wanting research + low brokerage |

| ICICI Direct | 0.25%–0.55% (equity), ₹20 per order (Neo plan) | ₹0 | ₹700/year | Trusted bank-backed broker, 3-in-1 account | Long-term investors, high trust |

| HDFC Securities | 0.3%–0.5% (equity) | ₹999 | ₹750/year | Bank-linked, strong advisory, good for HNI clients | Investors wanting integrated services |

| Kotak Securities | 0.25%–0.5% (equity), ₹20/order (Trade Free plan) | ₹0–₹499 | ₹600/year | Zero brokerage intraday in some plans | Intraday traders & bank customers |

| Sharekhan | 0.1%–0.5% | ₹0 | ₹400–₹750/year | Legacy broker, research support, good trading app | Investors wanting research support |

| 5paisa | ₹20/trade flat | ₹0 | ₹300/year | Budget broker, Robo advisory, packs for frequent traders | Cost-conscious traders |

| Groww | ₹20/order flat | ₹0 | ₹0 | Simple app, popular among millennials, mutual funds friendly | Beginners & investors |

| Fyers | ₹20/order flat | ₹0 | ₹0 | Advanced charts, free APIs, good for technical traders | Experienced traders & algo traders |

| Motilal Oswal | 0.2%–0.5% (equity) | ₹0 | ₹400–₹700/year | Strong research reports, PMS & wealth management | Research-driven investors |

Key Observations

- Lowest brokerage: Zerodha, Upstox, Angel One, 5paisa, Groww, Fyers (₹20/order flat).

- Best for beginners: Groww (easy UI), Angel One (research + low brokerage).

- Best for traders: Zerodha (robust platform), Upstox (strategy tools), Fyers (advanced charts).

- Best for long-term investors: ICICI Direct, HDFC Securities, Motilal Oswal (bank integration, research support).

- Best mix of research + discount pricing: Angel One.

Pros and Cons

Discount Brokers (Zerodha, Upstox, Angel, Groww, Fyers, 5paisa)

✅ Low brokerage charges

✅ Tech-driven platforms

❌ Limited research/advisory

Full-Service Brokers (ICICI, HDFC, Kotak, Sharekhan, Motilal Oswal)

✅ Research reports, advisory, relationship managers

✅ Bank integration, multiple investment products

❌ High brokerage costs

Conclusion

Choosing the right broker depends on your investment style:

- If you are a beginner → Groww, Angel One.

- If you are an active trader → Zerodha, Upstox, Fyers.

- If you are a long-term investor → ICICI Direct, HDFC Securities, Motilal Oswal.

- If you want research + advisory → Angel One, Sharekhan, Motilal Oswal.

The Indian brokerage industry is evolving rapidly with discount brokers gaining massive popularity. However, full-service brokers still have an edge in advisory and integrated services.

Basic Stock Market Terminology

Initial Public Offering (IPO):

Post Comment