Understanding the Derivatives Market

The Derivatives Market is one of the most important segments of the financial world, often used by traders, investors, and institutions to manage risks or enhance returns. Unlike direct investments in stocks or bonds, derivatives derive their value from an underlying asset such as equities, currencies, commodities, or market indices.

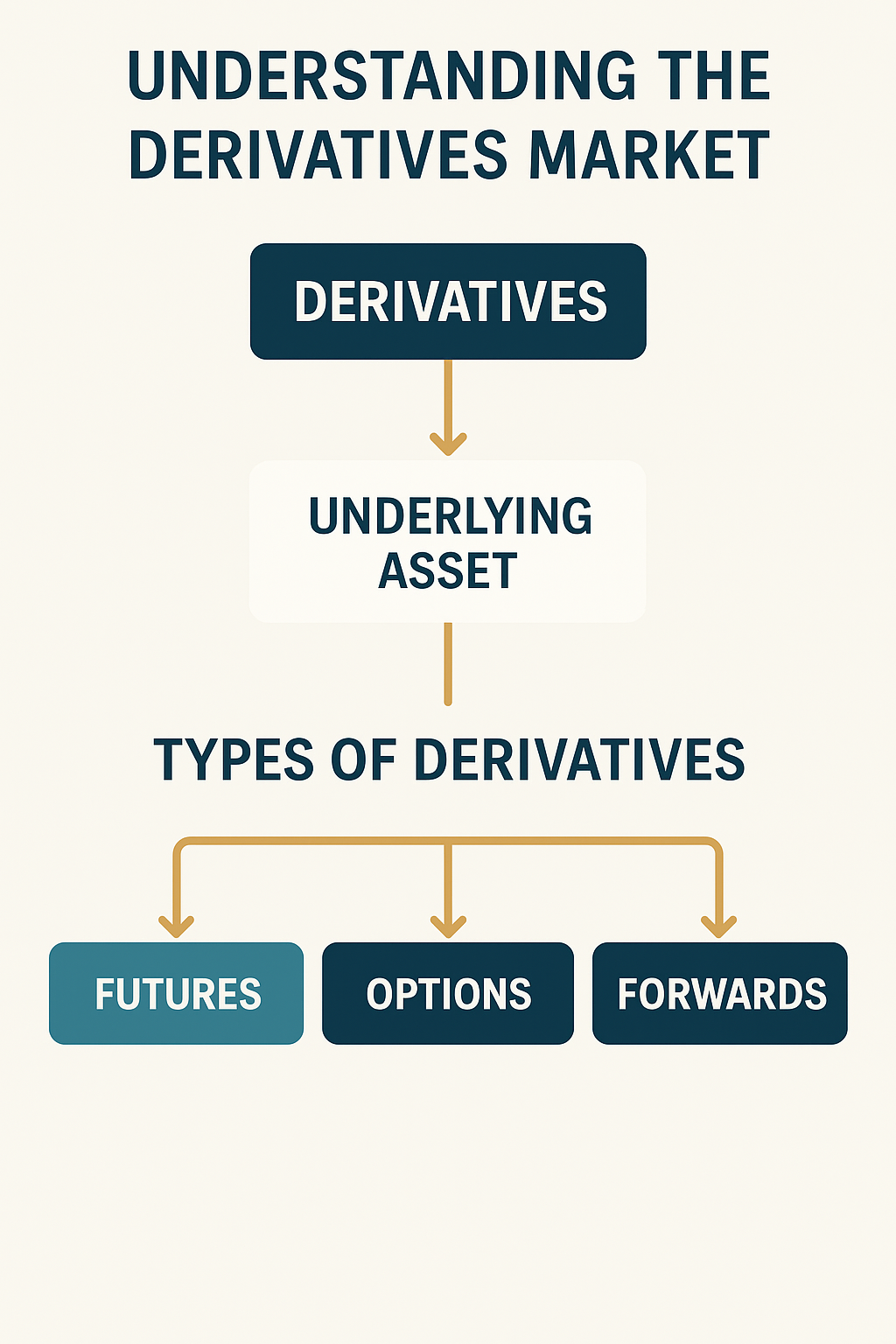

🔹 What Are Derivatives?

A derivative is a financial contract whose value depends on the price of an underlying asset. Instead of owning the actual asset, traders use derivatives to speculate on future price movements or to hedge against risks.

For example, instead of buying gold directly, a trader may enter into a gold futures contract to profit from price changes without holding physical gold.

🔹 Types of Derivatives

- Futures Contracts

- Agreement to buy or sell an asset at a predetermined price on a future date.

- Widely used in commodities, stocks, and indices.

- Options Contracts

- Give the buyer the right, but not the obligation, to buy (Call Option) or sell (Put Option) an asset at a fixed price before expiration.

- Useful for hedging risks and speculative strategies.

- Forwards

- Similar to futures but traded over-the-counter (OTC) rather than on exchanges.

- Customized contracts between two parties.

- Swaps

- Contracts to exchange cash flows, such as interest rate swaps or currency swaps.

- Mostly used by large corporations and financial institutions.

🔹 Why Are Derivatives Important?

- Hedging: Reduce the impact of market volatility (e.g., exporters hedge against currency fluctuations).

- Leverage: Allow traders to control large positions with small capital.

- Price Discovery: Help in determining the future expectations of an asset’s price.

- Liquidity: Enhance overall liquidity in financial markets.

🔹 Risks in Derivatives

While derivatives are powerful tools, they carry certain risks:

- High Volatility: Prices can change rapidly.

- Leverage Risk: Small price movements can lead to large gains or losses.

- Complexity: Requires good knowledge of financial markets.

- Counterparty Risk: Especially in OTC contracts like forwards and swaps.

🔹 Derivatives in the Indian Market

In India, derivatives are primarily traded on NSE and BSE, with products like:

- Index Futures & Options (Nifty, Bank Nifty)

- Stock Futures & Options

- Currency Derivatives

- Commodity Derivatives (via MCX, NCDEX)

They are regulated by SEBI to ensure transparency and safety for investors.

✅ Conclusion

The Derivatives Market is a key pillar of modern finance. It enables investors to hedge risks, speculate on price movements, and improve market efficiency. However, beginners should approach derivatives carefully, as the high leverage and complexity can lead to significant losses without proper understanding.

For anyone interested in stock trading, commodities, or currencies, learning about derivatives is an essential step toward building a strong financial foundation.

📌Disclaimer – At BullBearFin, we don’t provide trading tips but focus on helping you understand financial markets better so you can make informed decisions.

Post Comment