Strategies

bull call spread, bull call spread advantages, bull call spread calculator, bull call spread example, bull call spread explained, bull call spread for beginners, bull call spread in options trading, bull call spread nifty, bull call spread options strategy, bull call spread payoff, bull call spread reliance, bull call spread risks, bull call spread strategy, bull call spread vs bull put spread, bull call spread vs naked call, bull call spread with example

bullbearfin

0 Comments

Bull Call Spread Strategy Explained

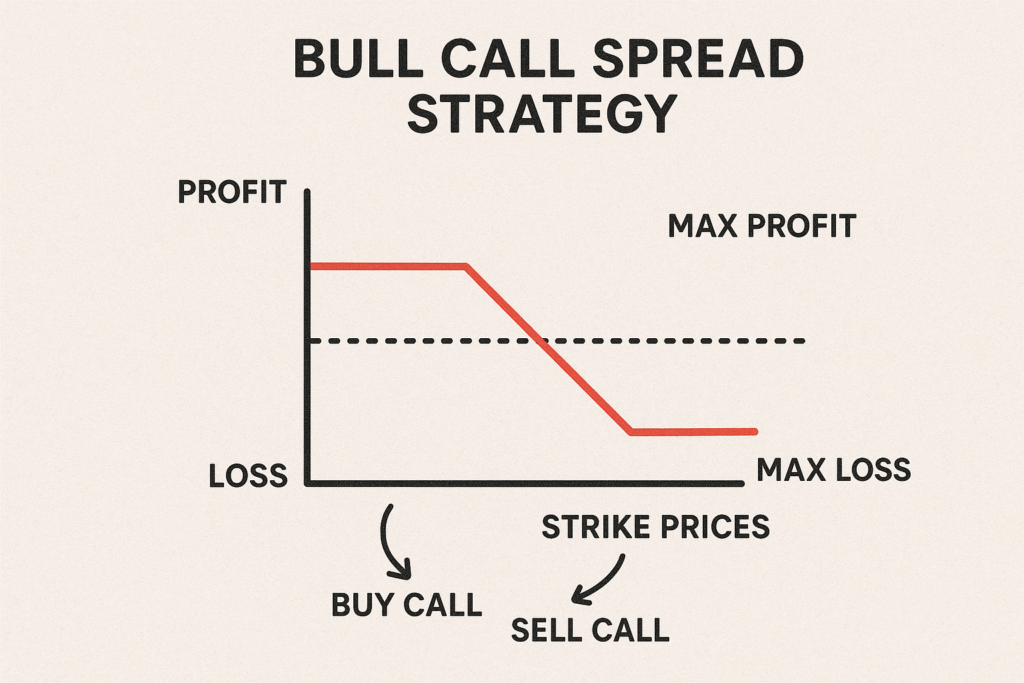

Options trading provides market participants with a wide range of strategies to express directional views while managing risk. Among these, the Bull Call Spread is a widely used strategy designed for traders who expect a moderate rise in the underlying asset’s price within a specified time horizon.

Rather than buying a naked call—which involves higher upfront cost and unlimited risk of time decay—the Bull Call Spread provides a defined-risk, defined-reward framework. This makes it particularly suitable for retail traders, conservative investors, and those seeking capital efficiency.

This article provides a comprehensive explanation of the Bull Call Spread strategy, covering its structure, payoff mechanics, advantages, limitations, and practical examples from both stocks and indices.

1. Definition of a Bull Call Spread

A Bull Call Spread is a vertical spread strategy that involves:

- Buying one call option at a lower strike price (ATM or ITM).

- Selling another call option at a higher strike price (OTM), with the same expiry.

Both options belong to the same underlying and same expiry series.

- The purchased call provides long exposure to potential price appreciation.

- The sold call generates premium income, thereby reducing the net cost of the trade.

- However, this also caps the profit potential beyond the higher strike.

In essence, the Bull Call Spread allows a trader to take a bullish view at a lower cost, but with a limited upside.

2. When to Deploy a Bull Call Spread

This strategy is most effective when:

- The trader is bullish, but not aggressively so.

- The expectation is for a moderate rise in the underlying, rather than a sharp rally.

- The trader seeks cost reduction compared to a naked call position.

- Risk management and capital efficiency are key considerations.

Typical use cases include:

- Entering ahead of corporate earnings or events, where a modest positive move is anticipated.

- During trending but non-volatile markets.

- For retail traders managing limited capital.

3. Mechanics of the Bull Call Spread

Step 1: Buy Lower Strike Call

This provides bullish exposure. Example: Buy Reliance 2500 CE at ₹120.

Step 2: Sell Higher Strike Call

This generates premium to offset the cost. Example: Sell Reliance 2600 CE at ₹60.

Step 3: Calculate Net Premium Paid

Net Debit = Premium Paid – Premium Received = ₹120 – ₹60 = ₹60.

This ₹60 is the maximum loss potential per share.

Key Metrics

- Maximum Loss = Net Premium Paid

- Maximum Profit = (Higher Strike – Lower Strike) – Net Premium Paid

- Breakeven Point = Lower Strike + Net Premium Paid

4. Numerical Example (Stock-Based)

Consider Reliance Industries Ltd. (RIL), trading at ₹2,500.

- Buy 2500 CE @ ₹120

- Sell 2600 CE @ ₹60

- Net Premium Paid = ₹60 (₹6,000 for one lot of 100 shares)

Expiry Scenarios

Case 1: RIL at or below ₹2,500

- Both calls expire worthless.

- Net Loss = ₹6,000 (maximum loss).

Case 2: RIL at ₹2,550

- 2500 CE intrinsic value = ₹50 (₹5,000).

- 2600 CE = worthless.

- Net P/L = ₹5,000 – ₹6,000 = –₹1,000.

Case 3: RIL at ₹2,600

- 2500 CE intrinsic value = ₹100 (₹10,000).

- 2600 CE = worthless.

- Net Profit = ₹10,000 – ₹6,000 = ₹4,000 (breakeven crossed).

Case 4: RIL at ₹2,650

- 2500 CE intrinsic value = ₹150 (₹15,000).

- 2600 CE intrinsic value = ₹50 (₹5,000).

- Net P/L = ₹10,000 – ₹6,000 = ₹4,000 (profit capped).

👉 Summary

- Maximum Loss = ₹6,000

- Maximum Profit = ₹4,000

- Breakeven = ₹2,560

5. Payoff Characteristics

The payoff structure is defined and symmetric:

- Maximum Risk: Limited to the net debit paid.

- Maximum Reward: Limited to the difference between strikes minus the debit.

- Breakeven Point: Lower Strike + Net Debit.

This ensures clarity of potential outcomes before entering the position.

6. Advantages of a Bull Call Spread

- Lower Cost: Premium outflow is significantly less compared to a naked call.

- Defined Risk: The maximum loss is fixed and known in advance.

- Capital Efficiency: Requires less margin compared to other bullish strategies.

- Ideal for Moderate Views: Suited for traders expecting small to medium price appreciation.

7. Limitations of a Bull Call Spread

- Capped Profitability: Gains beyond the upper strike are forfeited.

- Impact of Time Decay: If the underlying stagnates, theta decay can erode the position.

- Limited Applicability: Not suitable for strongly bullish views where unlimited upside is desired.

- Liquidity Risk: On certain stocks, option spreads may have wider bid-ask spreads.

8. Bull Call Spread vs. Alternative Strategies

| Strategy | Risk | Reward | Suitable View |

|---|---|---|---|

| Naked Call Buy | Premium paid | Unlimited | Strongly bullish |

| Bull Call Spread | Limited (low) | Limited | Moderately bullish |

| Bull Put Spread | Limited (low) | Limited | Moderately bullish (using puts) |

| Covered Call | Limited downside | Limited upside | Neutral to mildly bullish |

The Bull Call Spread is often favored when a trader wants to express a view without the high cost of naked call buying.

9. Example with Nifty Index

Assume Nifty is at 24,800.

- Buy 24,800 CE @ ₹220

- Sell 25,200 CE @ ₹100

- Net Premium = ₹120 (₹6,000 per lot, lot size 50).

At Expiry

- Below 24,800: Max loss = ₹6,000.

- At 25,200: Max profit = (400 – 120) × 50 = ₹14,000.

- Above 25,200: Profit capped at ₹14,000.

👉 A clear, cost-effective way to play for a moderate up-move in Nifty.

10. Practical Tips for Traders

- Strike Selection:

- Buy ATM or slightly ITM call.

- Sell OTM call near your price target.

- Expiry Selection:

- Use near-term expiry for lower cost.

- Avoid long-term spreads as theta works against the buyer.

- Avoid During High Volatility:

- Expensive premiums make spreads less attractive.

- Exit Early if Target Achieved:

- Don’t always wait for expiry; spreads can be squared off earlier.

11. Who Should Consider This Strategy?

- Retail traders seeking limited-risk exposure.

- Beginner option traders looking for structured, safer trades.

- Moderately bullish investors who expect steady price appreciation.

- Capital-constrained traders who want a cost-effective bullish position.

12. Conclusion

The Bull Call Spread remains one of the most practical and risk-efficient option strategies for moderately bullish traders. By combining a long call with a short call at a higher strike, traders reduce upfront costs and define risk, while also accepting a cap on profit potential.

This balance of cost, risk, and reward makes the Bull Call Spread an essential strategy in the toolkit of any serious options trader. While it does not cater to aggressive bullish views, it offers an elegant solution for those seeking disciplined exposure to upside movement.

13. Frequently Asked Questions (FAQs)

Q1. What is the maximum profit potential?

The difference between the strike prices, minus the net premium paid.

Q2. What is the maximum loss?

The net premium (debit) paid for the spread.

Q3. Is this suitable for beginners?

Yes. Its limited-risk nature makes it safer than naked call buying.

Q4. Can this be used on indices like Nifty and Bank Nifty?

Yes. In fact, it is one of the most common spread strategies deployed on indices.

Q5. When should I avoid a Bull Call Spread?

When expecting a sharp, strong rally. In such cases, a naked call may be more rewarding.

✅ Key Insight:

The Bull Call Spread is a cost-effective, risk-defined strategy for moderately bullish markets. By reducing the premium outlay while capping profit, it balances safety with opportunity—an ideal approach for disciplined traders.

📌Disclaimer – At BullBearFin, we don’t provide trading tips but focus on helping you understand financial markets better so you can make informed decisions.

Post Comment